》Click to view SMM spot aluminum quotes

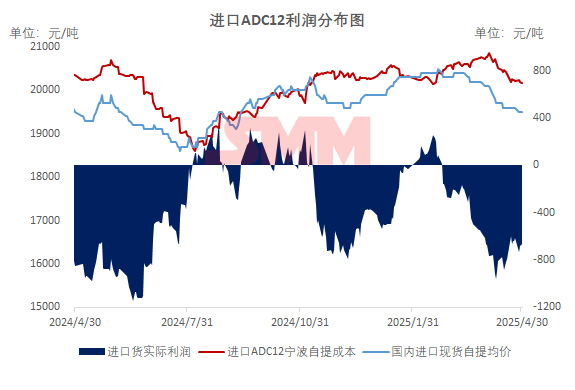

[Sluggish sentiment for stockpiling before the holiday, poor trading in the secondary aluminum market] Today, aluminum prices rose slightly by 40 yuan/mt to 20,060 yuan/mt, with domestic SMM ADC12 prices remaining in the range of 20,400-20,600 yuan/mt. In the import market, overseas ADC12 quotes remained at $2,430-2,450/mt, with the instant loss of imported ADC12 hovering around 700 yuan/mt. Affected by the 2-5 day holiday arrangements of downstream enterprises and insufficient willingness to stockpile before the Labour Day holiday, market trading continued to be sluggish on the last trading day before the holiday. Currently, the market's expectations for May demand are generally weak, and ADC12 prices are expected to maintain a weak consolidation pattern in the short term.

Note: Import profit refers to real-time profit.